As the People Bank of China (PBoC) has issued a notice on tightening the management of payment acceptance terminals and related businesses in October 2021, such management policy will be imposed on March 31, 2022.

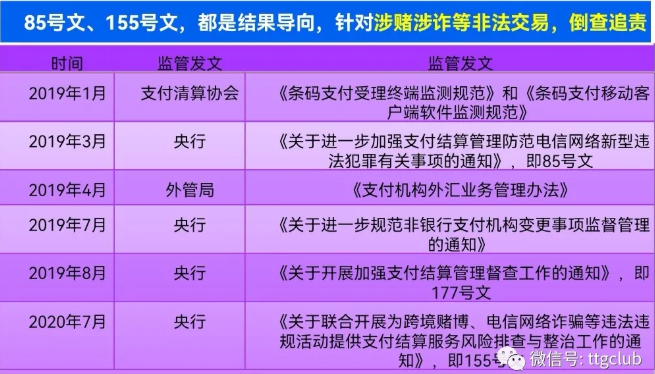

In the document, the PBoC has again emphasised the risk prevention and control of merchant payment and acquiring. From the perspective of recent years, the PBoC has frequently issued documents to strengthen supervision and reminding risks. Due to the non-compliance of merchant risk inspections related to payment acquiring, the supervision issued fines to financial institutions. In 2020, the fines reached 628 million RMB.

In the actual operation of banking industry, how to systematically prevent risks and conduct full life-cycle risk prevention and control for banks' merchants are very important. Taotaogu and Tencent Cloud jointly provide corresponding complete solutions for cooperating banks.

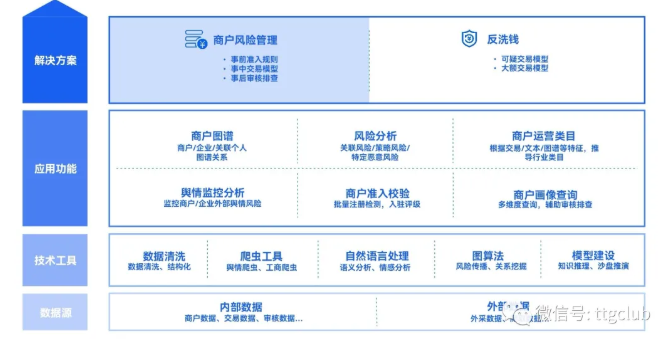

The Merchant (full life-cycle) Risk Management solution is a complete set of intelligent risk control system, which provides complete and operable solutions for merchant approval, in-process transaction models and post-event manual screening and review, and supports on-premise independent deployment in bank.

The core advantage of the product lies in the risk control tags accumulated by WeChat Pay in years of battle experience with illegal industries, which can greatly improve the effectiveness of bank’s acquiring business risk control. At the same time, it also covers Tencent Financial Technology's rich application experience in many security risk control scenarios.

In-depth analysis of merchant orders, refunds, cash withdrawals and other transaction data uses expert rules, deep neural networks, time series analysis, gradient trees and other technical methods to effectively capture merchants' high-risk behaviours such as click farming, cashing out, gambling, and illegal fundraising.

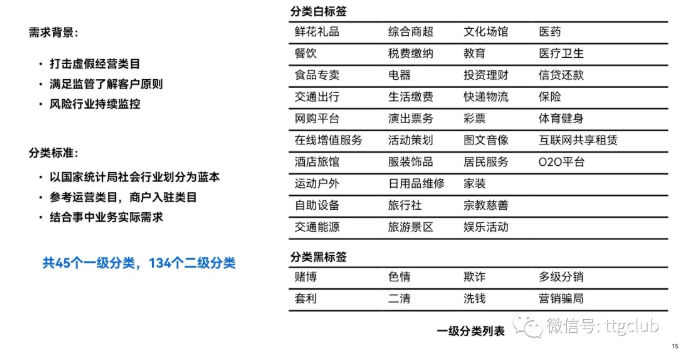

The intelligent risk control algorithm engine is completely based on the analysis of merchant’s transaction data, which can identify the authenticity of the merchant’s business category with high accuracy, combat merchants’ feigning and deceiving behaviour, and can restore merchant’s 45 first-level classifications and 134 secondary classifications.

The unique merchant insight management function provides comprehensive 24-hour insight into key merchants to prevent risks.

The following accuracy rate of risk control models in bank's specific business scenarios is based on a historical project of a cooperating bank (for reference only):

Click Farming/Cashing out Model: >=95%

Suspicious large amount Model: >=90%

Merchant gambling Model: >=70%

First-level classification result: >= 95%

Secondary classification result: >= 90%