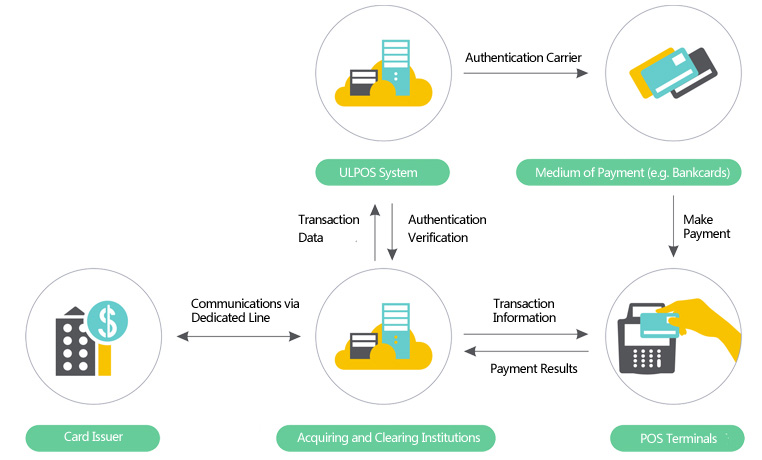

Refers to a category of electronic authentication based on the discount offer of merchants in marketing campaigns. After the authentication is added to bankcards, the system will allow automatic clearing and settlement of discount off the purchase price.

Refers to a category of electronic authentication based on the cash coupon offer of merchants. After the authentication is added to bankcards, the system will allow automatic deduction off the purchase price.

Refers to a category of electronic authentication based on the reward points marketing of merchants. After the authentication is added to bankcards, the system will allow automatic accumulation of reward points off the purchase price.

Refers to a category of electronic authentication for membership identification to be linked with bankcards. Thus, bankcards also act as membership cards and allow membership rights during transaction.